fha gift funds donor requirements 4000.1

HUD Handbook 40001 outlines the acceptable down payment sources for FHA loans. Gift Funds Already Received.

Fha Gift Funds How Can I Use Them To Buy A Home

Most notably from a qualifying and documentation standpoint may be student loans and the documentation of Gift funds.

. FHA Handbook 40001 p237 aAcceptable Sources of Gifts Funds Gifts may be provided by. Any large deposits will need to be explained and documented. The gift donor may not be a person or entity with an interest in the sale of the property such as the seller.

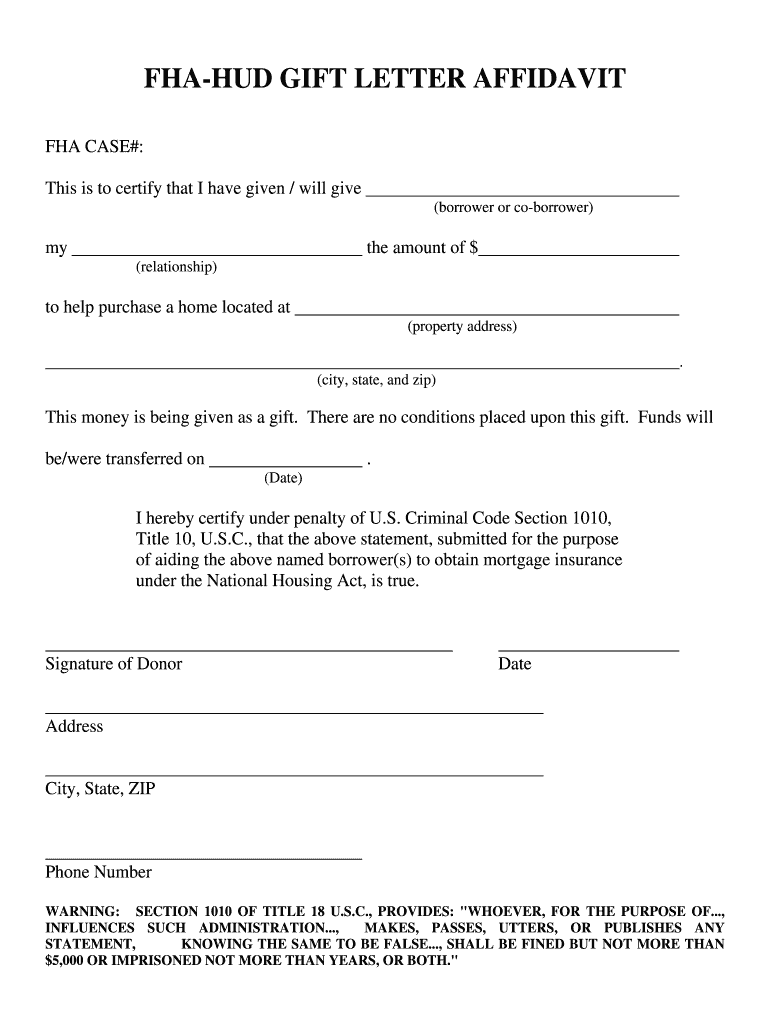

Provide executed gift letter. FHA Gift Funds Guidelines For Down Payment And Closing Costs. FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned.

However gift funds cannot be a loan. 41551 5B4b Who May Provide a Gift An outright gift of the cash investment is acceptable if the donor is the borrowers relative. Borrowers who use this program to buy a house can only use funds from an approved source.

Effective immediately All FHA transactions utilizing gift funds must include all required documentation as indicated per the 40001 specific to documenting the transfer of gifts see HUD Handbook 40001 guidelines below. FHA is issuing a whole new Handbook 40001 that is going to into effect today and will replace all the current HUD handbooks. Documenting the Transfer of Gifts The Mortgagee must verify and document the transfer of gift funds from the donor to the Borrower in accordance with the requirements below.

Below are 5 of some of the more major changes we will see per the new HUD Handbook 40001. If you are applying for a FHA loan the FHA Certification section must be signed by. FHA Gift Funds Guidelines.

Gifts from these sources are considered inducements to. Family Members Friends Employers Charities. A member of the borrowers family.

Requirements of the Gift. However as you will see in the requirements of the gift Im going to describe below the gift must meet an important condition namely that it cannot be a loan disguised as a gift. As long as the gift and giver meet certain FHA requirements gift funds can be used as a down payment.

Yes as part of the revised HUD Handbook 40001 the Handbook issued March 27 2019 HUD clarified its requirements for verifying and documenting the transfer of gifts from a donor to a Borrower. The FHA doesnt just list who may give such a gift--it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment. The audit found that loanDepots FHA-insured loans with down payment assistance gift funds and secondary financing did not always comply with HUD requirements.

Occupancy documentation for owner occupied FHA Streamline Refinances. Gift fund documentation for source and receipt of gift funds used to close. The donor cannot have borrowed the gift funds thru an unsecured loan.

According to HUD Handbook 40001 FHA down payment gifts may be provided by. A close friend with a clearly defined and documented interest in the Borrower. FHA loan rules in HUD 40001 state that the lender and its affiliates cannot provide a loan of gift funds to the donor unless the terms of the loan are equivalent to those available to the general public.

All of your down. A governmental agency or public Entity that has a program providing homeownership assistance. Hundreds of FHA Handbooks Mortgagee Letters Housing Notices and other policy documents have been consolidated into this single source.

FHA allows home buyers to get 100 gifted funds for down payment and closing costs. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. If the gift funds have been verified in the Borrowers account obtain the donors bank statement showing the.

What does this mean. Gift Funds are not. As a result it put the FHA insurance.

Gift funds are commonly used for home loan expenses including down payments but when the borrower accepts gift funds for the purpose of making that down payment the funds must meet FHA acceptability standards. In other words the gifted funds must truly be a gift and not a loan. The borrowers employer or labor union.

Here are some guidelines when using a gift fund for FHA. The Borrowers Family Member. FHA ONLY Donors ability must be verified by receipt of a copy of their most recent bank statement.

The bank statement needs to show proof of the gift funds leaving the donors bank account and into the home buyers bank account if it is from a bank wire transfer or provide a canceled check to. Keep reading below for a closer look at these FHA loan requirements. There is a letter that the donor needs to sign certifying that the gift funds are not a loan and.

Major Changes In FHA Guidelines With Gift Funds Homebuyers getting gift funds for their down payment need to have the gift fund donor provide 30 days of bank statements. The portion of the gift not used to meet closing requirements may be counted as reserves. The real estate agent or broker.

Occupancy documentation requirements for FHA Streamline Refinances Purpose This announcement includes the following topics per the FHA Handbook 40001. Apart from the requirement that the down payment must be gifted to the borrower by approved donors as defined by the HUD there are other requirements that must be met. The Federal Housing Administrations FHA Single Family Housing Policy Handbook 40001 SF Handbook is a consolidated consistent and comprehensive source of FHA Single Family Housing policy.

Specifically the Handbook now indicates in relevant part. Down payment funds may come from savings cash saved at home investments and more. You can have the money gifted to you but you cannot borrow it from someone else.

The Borrowers employer or labor union. Per FHA Gift Funds Guidelines family members or relatives can give a home buyer gift funds up to 100 to be used towards a home purchase andor closing costs. We received clarification from HUD that the red items are required when sourcing donor funds.

Dave Vawter - April 27 2017 0721. FHA 40001 Gift guidelines clarification 04272017.

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Business Letter Template

Equity Letter Template Luxury Gift Letter Template Uk Download Letter Gifts Letter Templates Letter Template Word

Can I Use Gift Money For My Fha Home Loan Down Payment Fha News And Views

Fha Loan Rules For Gift Funds Fha News And Views

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Loan Rules For Down Payment Gift Funds

Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan Mortgage Loans Fha Loans Mortgage

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Hud Gift Letter Affidavit Fill And Sign Printable Template Online Us Legal Forms

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Gift Money For Down Payment And Gift Letter Form Download Lettering Letter Gifts Letter Template Word