osceola county property taxes due

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. As part of our commitment to provide citizens with efficient convenient service the Village has partnered with Official Payment Corporation to offer payment of your personal property taxes over the internet or by telephone by calling 1-800-272-9829.

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola Tax Collector Website.

. How can we improve this page. Yearly median tax in Osceola County. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143.

The fall tax payment is due September first and may be paid without penalty on or before September 30th. Find Osceola County Michigan assessor assessment auditors and appraisers offices revenue commissions GIS and tax equalization departments. Receive a 3 discount on payment of real estate and tangible personal property taxes.

Visit their website for more information. All personal property taxes are payable to the Village of Osceola and due by January 31st of each year. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The county treasurers in northwest Iowa remind you that there are three different ways to pay your taxes. Osceola County Equalization Department 301. Osceola County Contact Info.

BSA Software provides BSA Online as a way for municipalities to display information online and is not. If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location. 197482 the delinquent property owner can redeem a tax lien certificate at any time until the property is sold at the Osceola County Florida tax deed sale or until the Osceola County Florida tax lien certificate expires which is.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Attention Osceola County business owners the deadline to file your tangible personal property TPP return is April 1st. What is the due date for paying property taxes in Osceola county.

The Tax Collectors Office provides the following services. First Half of Taxes DUE Septmeber 1st. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

These taxes are due Monday February 28 2022 by 500pm. Local Business Tax Receipts become delinquent October 1st and late fee applies. If you have a mortgage your property taxes are probably paid by your lender through an escrow account.

712 754 2241 Phone 712 754 3782 Fax Get directions to the county offices. If you dont pay by the due date you will be charged a penalty and interest. Learn how Osceola County levies its real property taxes with our detailed review.

If you would like to pay when we are closed or prefer not to come inside we have a walk-up secured drop box that is located to the right of the main entrance doors on the front side of our building. The Property Appraisers Office assesses the value of tangible personal property and presents a certified tax roll to the Tax Collector. Failure to file your TPP Return by the deadline is subject to penalty per Florida Statute 193072.

You may utilize our online filing system or mail your TPP Return to our office. Learn all about Osceola County real estate tax. Full amount due on property taxes by March 31st.

Welcome to the Tax Online Payment Service. Irlo Bronson Memorial Hwy. Receive 1 discount on payment of real estate and tangible personal property taxes.

This service allows you to make a tax bill payment for a specific property within your Municipality. Welcome to Osceola County Iowa. An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer taxes.

Winter taxes are due by February 14 without penalty. Discover Mastercard Visa and e-Check are accepted for Internet Transactions. Summer taxes are due by September 14 without interest.

When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of either payment stub. Property taxes are due on September 1. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest. Search all services we offer. After 500pm After this time all unpaid taxes will be sent as delinquent to the Livingston County Treasurer.

Enjoy online payment options for your convenience. To begin please enter the appropriate information in one of the searches below. Iowa Property Taxes Are Due March 5 2018 - 1133 pm - Posted in News Northwest Iowa If you havent paid them yet you have about four weeks left to pay the final installment of 2017-18 property taxes in Iowa without having to pay a penalty.

Burdell Township Assessor 17827 Pine River School Road Le Roy MI. For more details about taxes in Osceola County or to compare property tax rates across Iowa see the Osceola County property tax page. The deadline for submission of your 2021 Tangible Personal Property Tax Return is April 1 2022.

It is the job of the Tax Collector to mail the tax notices and collect the monies due. Tax statements are mailed on November 1st of each year with payment due by March 31st of the following year.

Vaulted Ceiling Means Stone To Ceiling Fireplace Right How Amazing Is This Prostack Lite Platinum Cosmo Fireplace Fireplace Design Fireplace Great Rooms

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Fl Property Tax Search And Records Propertyshark

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Osceola County Fl Property Tax Search And Records Propertyshark

Distrito Escolar Del Osceola County School District

Osceola County Tax Collector Office Of Bruce Vickers Serving Our Citizens With Dignity Respect

Pin By Michele Mehnert On Homebuying Business Tax Property Tax Home Buying

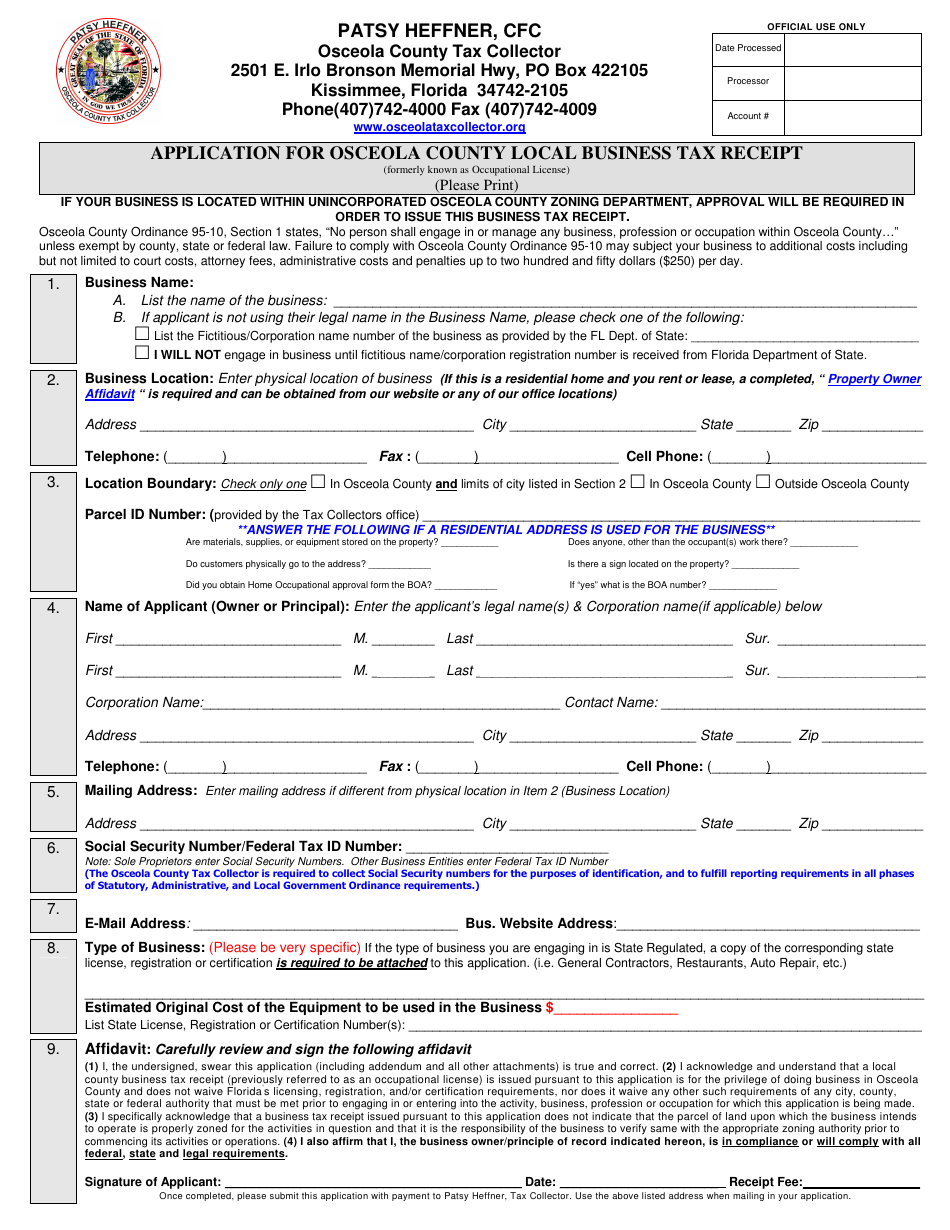

Osceola County Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Compass Bay 4 Bedrooms Close To Disney In Orlando Area 5128k Kissimmee Bedroom Night House Rental Ideal Home

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Tax Collector Office Of Bruce Vickers Serving Our Citizens With Dignity Respect